Mục lục

ToggleVietnam’s solar panel industry is experiencing unprecedented growth, driven by rising energy demands and the country’s commitment to sustainable development. However, challenges such as supply chain disruptions, regulatory hurdles, and the need for advanced technology adoption still impede its full potential. In this article, FBC provides an insightful overview of Vietnam’s solar panel market, highlighting key trends and outlining strategic solutions to overcome existing obstacles.

Vietnam’s Strategic Position in Global Solar Panel Supply Chains

Vietnam’s geographic and economic advantages have created an ideal environment for solar panel production and distribution across international markets.

- Vietnam’s emergence as a solar manufacturing hub in Southeast Asia

The transformation of Vietnam into a solar manufacturing powerhouse began in earnest around 2018, when trade tensions between major economies created opportunities for alternative production locations. Today, Vietnam hosts over 47 solar panel companies, including major international players like Longi Solar, JinkoSolar, and Canadian Solar, alongside emerging domestic manufacturers such as Bamboo Capital and Sao Mai Group.

Vietnamese solar panel production capacity has grown from 2.5 GW in 2019 to an impressive 18.7 GW by 2024, representing a 648% increase in just five years. This remarkable growth has positioned Vietnam as the fourth-largest solar panel exporter globally, capturing approximately 12% of the worldwide market share. The country’s manufacturing excellence has attracted partnerships with Fortune 500 companies, demonstrating the quality and reliability of Vietnamese-produced solar panel systems.

- Strategic advantages of Vietnam’s location for solar panel production

Vietnam’s strategic coastal position offers unparalleled logistics advantages for solar panel distribution. With 14 major ports including Hai Phong, Ho Chi Minh City, and Da Nang, Vietnamese manufacturers can efficiently reach markets across Asia, Europe, and the Americas with shipping times averaging 15-25 days to major destinations.

The country’s robust infrastructure network includes six international airports and over 2,600 kilometers of highways connecting manufacturing hubs to ports. This connectivity ensures that solar panel companies can maintain just-in-time delivery schedules while minimizing transportation costs – a critical factor given that logistics typically represent 8-12% of total solar panel cost. Additionally, Vietnam’s participation in 16 free trade agreements, including the Comprehensive and Progressive Trans-Pacific Partnership (CPTPP) and the EU-Vietnam Free Trade Agreement, provides preferential tariff access to markets representing over 60% of global GDP.

- Growth statistics and market trajectory

The Vietnamese solar panel industry’s growth trajectory reflects both domestic demand and export potential. Domestic solar installations reached 16.5 GW of cumulative capacity by late 2024, while the government’s National Power Development Plan VIII targets 47.3 GW of solar capacity by 2030.

Export revenues from solar panels and component sales exceeded $8.4 billion in 2024, making solar products Vietnam’s eighth-largest export category. The sector employs over 185,000 workers directly, with an additional 340,000 jobs in supporting industries, creating a comprehensive ecosystem that supports sustained growth.

The Solar Panel Manufacturing Landscape in Vietnam

Vietnam’s solar manufacturing ecosystem encompasses everything from raw material processing to complete solar panel system assembly, supported by both international corporations and innovative domestic companies.

- Key solar panel companies and manufacturers operating in Vietnam

The Vietnamese solar landscape features a diverse mix of established international brands and rapidly growing domestic manufacturers. Longi Solar operates two major facilities in Bac Giang and Hai Duong provinces with a combined annual capacity exceeding 3.2 GW, while JinkoSolar’s Quang Ninh facility produces approximately 2.8 GW annually of high-efficiency monocrystalline panels.

Domestic solar panel companies have also gained significant traction. Bamboo Capital Group has invested over $450 million in solar manufacturing facilities across three provinces, focusing on both domestic and export markets. Their partnership with European distributors has resulted in CE-certified products meeting stringent international quality standards.

- Types of solar panel systems produced locally

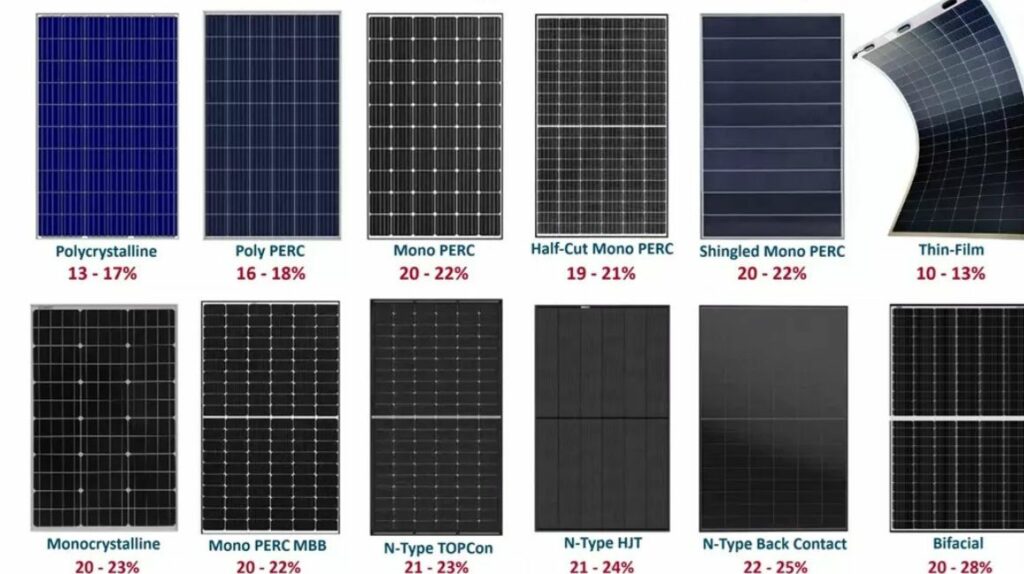

Vietnamese facilities produce the full spectrum of solar panel technologies, from traditional polycrystalline panels to cutting-edge bifacial and PERC (Passivated Emitter and Rear Cell) systems. Monocrystalline panels represent approximately 68% of production, reflecting global market preferences for higher efficiency products.

The country has become particularly competitive in producing large-format panels (over 500W capacity) and specialized applications, including floating solar systems and agrivoltaic solutions. Several facilities now manufacture panels with efficiency ratings exceeding 22%, competing directly with premium European and Japanese products while maintaining cost advantages of 15-20%.

- Quality standards and technological capabilities

Vietnamese solar panel manufacturers have invested heavily in quality control and certification processes. Over 85% of major facilities maintain ISO 9001:2015 quality management certification, while 73% have achieved IEC 61215 and IEC 61730 international safety standards for solar panels.

Advanced manufacturing techniques include automated cell stringing, precision glass cutting, and electroluminescence testing that identifies micro-defects invisible to conventional inspection methods. These quality control measures ensure that Vietnamese-produced panels consistently achieve 25-year performance warranties comparable to premium international brands.

Understanding Solar Panel Costs in the Vietnamese Market

Cost competitiveness remains one of Vietnam’s strongest advantages in the global solar panel market, driven by efficient manufacturing processes, favorable labor costs, and strategic supply chain management.

- Factors affecting solar panel price in Vietnam

Solar panel pricing in Vietnam reflects a complex interplay of manufacturing efficiency, raw material costs, and competitive market dynamics. Vietnamese manufacturers benefit from integrated supply chains that reduce raw material transportation costs by approximately 12-15% compared to facilities dependent on long-distance silicon wafer imports.

Labor productivity in Vietnamese solar facilities averages 15-20% higher than regional competitors, partly due to substantial investments in worker training and automated manufacturing equipment. This efficiency translates directly into lower production costs, allowing Vietnamese manufacturers to offer competitive solar panel prices while maintaining healthy profit margins.

- Competitive analysis of local vs imported solar panels

Vietnamese-manufactured solar panels typically cost 8-12% less than equivalent Chinese products and 25-30% less than European or American alternatives, while meeting identical international quality standards. This cost advantage has made Vietnamese suppliers increasingly attractive to large-scale solar developers and installation companies seeking to optimize project economics.

Local solar panel companies have also developed flexible pricing models, including volume discounts, extended payment terms, and comprehensive warranty packages that provide additional value beyond simple unit costs. Several manufacturers offer “performance guarantees” ensuring minimum energy output over 20-25 year periods, providing buyers with additional risk mitigation.

- Cost trends and future projections

Solar panel costs in Vietnam have declined steadily, following global trends while maintaining competitive advantages. Average pricing for high-quality monocrystalline panels decreased from $0.34 per watt in 2022 to $0.28 per watt in 2024, with further reductions anticipated as production scales increase.

Industry analysts project continued cost reductions of 3-5% annually through 2027, driven by manufacturing efficiency improvements and economies of scale. However, raw material price volatility, particularly for high-purity silicon and silver, could impact these projections depending on global supply and demand dynamics.

Advanced solar panel technologies, including bifacial and PERC systems, are expected to achieve cost parity with conventional panels by 2026, potentially shifting market preferences toward higher-efficiency products that offer better long-term value propositions.

- Government incentives influence solar panel cost.

Vietnamese government policies significantly impact solar panel costs through various incentive mechanisms and regulatory frameworks. The current feed-in tariff structure provides guaranteed purchase agreements for solar electricity at rates ranging from 7.09 to 9.35 cents per kWh, depending on project type and location.

Import duty exemptions for solar manufacturing equipment have reduced capital expenditure requirements for new facilities by approximately 12-15%, savings that manufacturers can pass along to customers through lower solar panel prices. Additionally, corporate income tax incentives of 10-15% for renewable energy manufacturers provide further cost advantages.

Vietnam’s Solar Panel Export and Distribution Networks

Vietnam’s strategic position and well-developed logistics infrastructure have created efficient pathways for solar panel distribution to global markets, supported by sophisticated supply chain management capabilities.

- Major export markets for Vietnamese-made solar panels

The United States represents Vietnam’s largest solar panel export market, accounting for approximately 34% of total shipments valued at over $2.8 billion in 2024. European markets, led by Germany, the Netherlands, and Spain, comprise another 28% of exports, benefiting from preferential tariff treatment under the EU-Vietnam Free Trade Agreement.

- Domestic distribution channels and logistics

Vietnam’s domestic solar panel distribution network has evolved into a sophisticated system serving both residential and commercial markets. Major distributors like Dien Quang Group and Rang Dong have established nationwide networks with over 2,400 retail outlets and service centers.

- Challenges and opportunities in supply chain management

Supply chain resilience has become increasingly important as Vietnamese solar panel manufacturers scale operations and expand globally. Raw material sourcing represents the primary challenge, with silicon wafer availability and pricing subject to global market fluctuations that can impact production schedules and costs.

Investment Landscape for Solar Panel Manufacturing in Vietnam

Foreign direct investment continues to flow into Vietnam’s solar sector, attracted by favorable policies, skilled workforce availability, and market access advantages that create compelling investment opportunities.

International investment in Vietnamese solar manufacturing reached $4.7 billion cumulatively through 2024, with major contributions from Japanese, South Korean, and European investors. Sumitomo Corporation’s $680 million investment in multiple solar facilities represents the largest single commitment, while dozens of smaller investments from specialized solar equipment manufacturers have created a comprehensive ecosystem.

Land use rights for solar manufacturing facilities can be secured for 50-70-year terms with renewal options, providing long-term investment security. Industrial park developers have created specialized renewable energy zones with pre-approved environmental assessments and utility connections, further reducing investment risks and startup timelines.

Technical Innovation in Vietnam’s Solar Panel Industry

Vietnam’s solar panel manufacturing industry has adopted advanced technologies and innovative processes, positioning the country as a hub of solar innovation rather than just low-cost production. Modern techniques like diamond wire sawing, PERC cell processing, and automated assembly enable the production of high-efficiency panels competitive with premium global brands. A standout strength is bifacial solar panel production using glass-glass construction, offering 30-year warranties that exceed industry standards.

Vietnam heavily invests in research and development (R&D), with centers like the National Renewable Energy Research Center collaborating internationally on projects such as floating solar and agrivoltaics. Private manufacturers allocate 2-3% of revenues to R&D, focusing on efficiency and durability improvements suited for tropical climates. Partnerships with universities, including Hanoi University of Science and Technology, provide skilled technical talent.

Sustainability is a competitive advantage, with many facilities achieving carbon-neutral production through renewable energy use. Water recycling rates reach 85-90%, glass recycling exceeds 95%, and silicon waste recovery approaches 98%, minimizing environmental impact and production costs.

FBC ASEAN 2025: Connecting Solar Industry Stakeholders

The FBC ASEAN trade exhibition represents a crucial platform for solar industry networking, bringing together manufacturers, buyers, and technology providers in Vietnam’s dynamic renewable energy ecosystem. As part of the broader manufacturing trade show, FBC ASEAN connects solar panel companies with the extensive network of over 40,000 manufacturing enterprises across Japan, Vietnam, Thailand, and China, facilitating comprehensive business relationships beyond traditional industry boundaries.

FBC ASEAN 2025 will feature dedicated solar and renewable energy pavilions showcasing Vietnamese solar panel companies alongside international partners and suppliers. FBC ASEAN 2025 is the International Manufacturing Trade Exhibition, held from September 17 to 19, 2025, at the National Exhibition Center (VNEC) in Dong Anh, Hanoi. The event is expected to feature over 500 booths and attract around 10,000 visitors from countries including Japan, Vietnam, Germany, South Korea, the US, and ASEAN. The exhibition focuses on connecting manufacturing and supporting industries, especially from Japan, China, and ASEAN, with major buyers like Panasonic and Samsung. Participants benefit from online networking platforms Emidas and J-TECH Showroom, combining both onsite and online exhibition formats, extensive media coverage, and special incentives for VASI members. Organized by NC Network Group in collaboration with industry associations and business support agencies, FBC ASEAN 2025 promises to be a key opportunity for manufacturers to connect, find partners, expand markets, and enhance competitiveness in the supply chain.

The exhibition’s focus on manufacturing excellence aligns perfectly with the solar industry’s emphasis on quality, reliability, and technical innovation. Vietnamese solar panel manufacturers can leverage this platform to showcase their technological capabilities, competitive pricing, and commitment to international quality standards to a targeted audience of decision-makers. The event’s unique positioning within the broader manufacturing ecosystem means solar companies can connect not only with direct buyers but also with potential partners in related industries such as automation, electronics, and industrial equipment manufacturing.

Major confirmed buyers, including industry leaders like Panasonic, Tiger, Fuji Films, and Samsung, demonstrate the caliber of procurement professionals attending the event, creating opportunities for solar panel companies to establish relationships with Fortune 500 companies and multinational corporations seeking reliable Vietnamese suppliers for their renewable energy initiatives.

Future Outlook: Vietnam’s Role in the Global Solar Panel Market

Vietnam’s trajectory in the global solar panel industry points toward continued growth and increasing technological sophistication, supported by favorable market conditions and strategic investments in innovation and capacity expansion.

- Projected growth of Vietnam’s solar manufacturing capacity

Industry forecasts indicate that Vietnamese solar panel production capacity will reach 28-32 GW annually by 2027, representing a 65-75% increase from current levels. This expansion will be driven by both existing facility upgrades and new greenfield investments from domestic and international manufacturers. The government’s Master Plan for Power Development through 2030 anticipates domestic solar demand reaching 47.3 GW, creating a substantial local market that will support continued manufacturing growth while reducing dependence on export markets for industry sustainability.

- Emerging trends in solar panel technology and applications

Floating solar systems represent a significant opportunity for Vietnamese manufacturers, given the country’s extensive coastline and reservoir systems. Local companies have developed specialized mounting systems and marine-grade panel designs that could be exported to similar tropical markets worldwide.

- Opportunities for international collaboration

Technology transfer partnerships will continue driving innovation in Vietnamese solar manufacturing, with opportunities for collaboration in areas including perovskite-silicon tandem cells, concentrated photovoltaics, and advanced energy storage integration.

Joint venture opportunities in third-country markets could enable Vietnamese companies to establish manufacturing presence in key export destinations, potentially reducing logistics costs and tariff exposure while maintaining competitive advantages in production efficiency and quality control.

As Vietnam’s solar panel industry continues to innovate and expand, it offers exciting opportunities for investors, manufacturers, and consumers alike. With cutting-edge technology and strong sustainability commitments, Vietnam is set to become a leading force in the global renewable energy market.

Stay informed on the latest developments, trends, and product launches by following FBC — your trusted source for industry insights and quality solar panel solutions. Visit our website regularly to access expert analysis and discover how you can benefit from Vietnam’s dynamic solar panel sector.